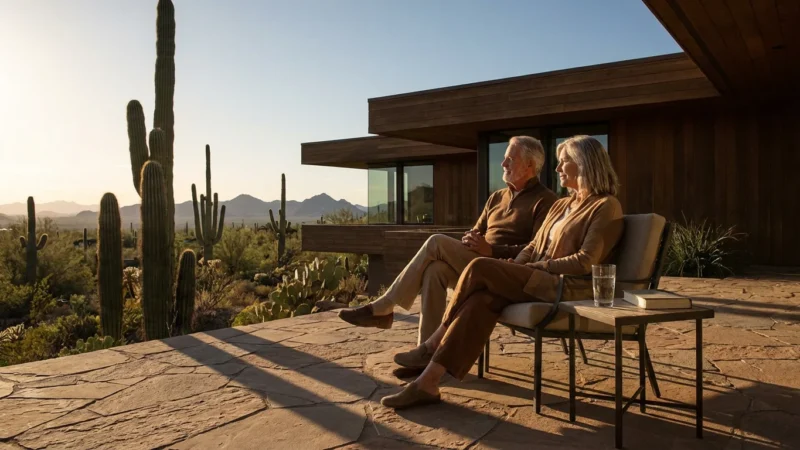

Colorado offers a compelling vision for retirement, blending majestic natural beauty with vibrant communities. Many active seniors find this state an ideal destination. Its reputation for outdoor recreation and abundant sunshine draws those who prioritize an active lifestyle.

The Centennial State is frequently recognized as one of the best retirement states for outdoor enthusiasts due to its world-class trail systems and parks.

Deciding where to spend your retirement years requires careful consideration of many factors. You likely weigh cost of living, climate, healthcare access, and the overall lifestyle a location provides. Colorado presents unique advantages and potential challenges you should explore thoroughly. This guide offers practical insights to help you determine if Colorado aligns with your retirement aspirations.

Table of Contents

- Why Consider Colorado for Retirement?

- Cost of Living in Colorado: A Practical Look

- Colorado’s Tax Landscape for Retirees

- Climate and Weather: Embracing the Seasons

- Healthcare Access and Quality for Seniors

- Thriving Communities and Lifestyle Options

- Outdoor Adventures for Active Seniors

- Popular Retirement Cities and Towns

- Relocation Planning: Your Step-by-Step Guide

- Frequently Asked Questions

Why Consider Colorado for Retirement?

Colorado stands out for its unique blend of breathtaking natural landscapes and dynamic urban centers. The state consistently ranks high for overall well-being and active lifestyles. Retirees often seek a place offering both tranquility and opportunities for engagement.

A move to the Centennial State is often the perfect time for embracing new hobbies and activities that make use of the vast trail systems.

Many prospective residents also evaluate the sun and scenery of Arizona as a potential alternative to the Rocky Mountains.

You find a strong emphasis on health and wellness throughout Colorado. Many residents embrace outdoor activities year-round. This focus on an active lifestyle can contribute significantly to a fulfilling retirement.

Cost of Living in Colorado: A Practical Look

Understanding the cost of living is crucial when planning your Colorado retirement. The state’s overall cost of living tends to be higher than the national average, driven primarily by housing expenses. Data from the Bureau of Labor Statistics and other sources often places Colorado’s cost of living index around 120-130, compared to the national average of 100.

For those seeking similar mountain vistas at a different price point, Idaho offers a slower pace and unique recreational opportunities.

Housing prices, particularly along the Front Range cities like Denver and Boulder, exceed national figures. However, you can discover more affordable housing options in smaller towns or on the Western Slope. Utilities, groceries, and transportation costs are generally moderate, though slightly above the national average in some areas.

| Category | Colorado Index (Avg.) | National Index (Avg.) |

|---|---|---|

| Overall Cost of Living | 121 | 100 |

| Housing | 145 | 100 |

| Groceries | 103 | 100 |

| Utilities | 95 | 100 |

| Transportation | 105 | 100 |

| Healthcare | 101 | 100 |

This table provides a generalized view. Your specific expenses depend on your chosen community and lifestyle. Researching local data for your preferred towns offers the most accurate picture.

Pros of Colorado’s Cost of Living

- Lower utility costs in some areas compared to many coastal states.

- Diverse housing markets, including more affordable options outside major metros.

- Access to free or low-cost outdoor recreation, offsetting other expenses.

Cons of Colorado’s Cost of Living

- Housing costs in prime Front Range locations remain significantly higher than the national average.

- Higher property taxes in some desirable areas.

- Overall cost of living generally requires a higher retirement income than many other states.

Colorado’s Tax Landscape for Retirees

When considering Colorado retirement, understanding the tax environment is essential. Colorado offers some tax benefits for seniors, making it a moderately tax-friendly state for retirees. The state has a flat income tax rate of 4.40%, which applies to most income.

Retirees often compare these policies to tax-friendly states like Delaware to determine where their fixed income goes furthest.

A key benefit for retirees aged 65 and older is the substantial deduction for retirement income. This allows you to deduct up to $24,000 per year from eligible public and private pension income, including 401(k) and IRA distributions. Social Security benefits are not taxed by the state of Colorado.

Property taxes vary significantly by county and specific location. They are generally lower than the national average but can still be substantial in high-value areas. Sales tax rates are moderate, with a statewide rate of 2.9%, though local jurisdictions add their own taxes. This results in combined sales tax rates that typically range from 2.9% to over 10%.

| Tax Type | Colorado Policy | Retiree Impact |

|---|---|---|

| Income Tax | Flat 4.40% | Retirement income deduction up to $24,000 for ages 65+. |

| Social Security Tax | Not taxed | Full exemption on Social Security benefits. |

| Property Tax | Average effective rate of 0.49% (varies by county) | Generally lower than national average, but can be higher in desirable areas. |

| Sales Tax | State 2.9%, plus local taxes (up to 10% combined) | Applies to most goods and services, excluding some necessities. |

| Estate/Inheritance Tax | None | No state estate or inheritance tax. |

For the most current and specific tax information, consult official state tax resources and the Tax Foundation.

Climate and Weather: Embracing the Seasons

Colorado’s climate is a significant draw for many active seniors. You experience four distinct seasons, abundant sunshine, and low humidity. However, the state’s diverse geography means climate varies considerably across regions.

This variety is a key consideration when comparing northern and southern retirement climates for your permanent home.

The high elevation and dry air are perfect for seniors avoiding extreme heat and humidity found in other regions.

The Front Range, encompassing cities like Denver, Colorado Springs, and Fort Collins, enjoys mild winters with moderate snowfall and plenty of sunny days. Summers are warm and dry, with average high temperatures in the 80s Fahrenheit. Mountain towns experience colder, snowier winters, ideal for winter sports enthusiasts, and cooler summers. The Western Slope, including areas like Grand Junction, offers a high desert climate with warmer temperatures and less humidity than the Front Range.

Altitude is an important factor. Many areas, particularly the mountains, sit at elevations exceeding 5,000 feet. Individuals with certain health conditions might need time to adjust or choose lower-elevation communities. The state averages over 300 days of sunshine annually, fostering an outdoor-centric lifestyle.

| City | Elevation (feet) | Avg. July High (°F) | Avg. Jan. High (°F) | Annual Sunny Days | Annual Snowfall (inches) |

|---|---|---|---|---|---|

| Denver | 5,280 | 89 | 46 | 300 | 57 |

| Colorado Springs | 6,035 | 86 | 44 | 243 | 38 |

| Grand Junction | 4,593 | 93 | 37 | 240 | 19 |

| Durango | 6,512 | 83 | 37 | 266 | 70 |

Source: National Weather Service historical data. Actual conditions vary annually.

Healthcare Access and Quality for Seniors

Access to quality healthcare is a paramount concern for retirees, and Colorado generally performs well in this area. The state boasts a robust healthcare infrastructure, particularly concentrated in its major metropolitan areas. You find numerous hospitals, specialized medical centers, and a wide array of healthcare providers.

The Denver Metro Area, Colorado Springs, and Fort Collins offer top-tier hospitals and medical facilities. These include university-affiliated hospitals and highly-rated specialty centers. Rural areas, while beautiful, might have fewer immediate healthcare options, requiring travel to larger towns for specialized care.

When considering “How expensive is healthcare for retirees in Colorado?,” costs are comparable to the national average, though individual expenses depend heavily on your insurance coverage. Most retirees rely on Medicare, and Colorado has a competitive market for Medicare Advantage and Medigap plans. You can research and compare plans to understand your specific costs and coverage options. The Medicare.gov website is an invaluable resource for this research.

Key aspects of Colorado’s healthcare for seniors

- High concentration of specialists and facilities in urban areas.

- Strong market for Medicare plans and supplemental insurance.

- Emphasis on active lifestyles potentially reduces healthcare needs.

- Rural access to immediate specialized care might be limited.

- Many hospitals and medical centers consistently receive high ratings.

“Livable communities are those that are safe and secure, have affordable and appropriate housing and transportation options, and offer supportive community features and services.”

Thriving Communities and Lifestyle Options

Colorado offers a wide spectrum of communities to suit various retirement lifestyles. You can choose from bustling cities, charming small towns, or secluded mountain retreats. This diversity allows you to find a place that truly feels like home.

Urban Retirement

Major cities like Denver, Colorado Springs, and Fort Collins provide extensive amenities. You find cultural attractions, diverse dining, shopping, and excellent healthcare. These cities also offer numerous opportunities for volunteering and lifelong learning. They cater to those who prefer a dynamic environment with immediate access to services.

Small Town Charm

Many smaller towns across Colorado provide a more relaxed pace of life. Places like Grand Junction, Salida, and Durango offer strong community ties and a slower rhythm, often with lower living costs. These towns typically still provide good access to outdoor activities and essential services, fostering a friendly, close-knit atmosphere.

55+ Communities

Colorado has a growing number of 55+ active adult communities, especially in the Front Range suburbs. These developments cater specifically to retirees, often featuring clubhouses, fitness centers, golf courses, and organized social events. They provide a maintenance-free lifestyle and built-in opportunities for social engagement. These communities help foster connections and activities among residents.

Outdoor Adventures for Active Seniors

Colorado is synonymous with outdoor recreation, making it an ideal destination for active seniors. The state’s natural beauty encourages year-round engagement with the environment. You will find countless opportunities to stay fit and explore.

“What are the best outdoor activities for seniors in Colorado?” The options are plentiful and varied. Hiking remains a top choice, with trails ranging from easy, paved paths to challenging mountain ascents. Many state and national parks offer accessible trails suitable for all fitness levels. Cycling is also incredibly popular, with an extensive network of paved bike trails and scenic routes.

Winter brings opportunities for cross-country skiing, snowshoeing, and even gentle downhill skiing at accessible resorts. Fly fishing, kayaking, and paddleboarding thrive in the warmer months on Colorado’s numerous rivers and lakes. Golf enthusiasts enjoy a long season on many stunning courses. The state’s abundant sunshine makes outdoor pursuits enjoyable almost any day of the year.

Popular Outdoor Activities for Seniors in Colorado

- Hiking and Walking: Accessible trails in state parks, national forests, and local open spaces.

- Biking: Paved recreational paths and scenic road cycling routes.

- Golf: Numerous courses throughout the state with stunning mountain backdrops.

- Fishing: Fly fishing, bait fishing in rivers, lakes, and reservoirs.

- Winter Sports: Cross-country skiing, snowshoeing, and beginner-friendly downhill skiing.

- Nature Photography: Capturing the diverse landscapes and wildlife.

- Bird Watching: Diverse ecosystems attract a wide variety of bird species.

The key is choosing activities appropriate for your fitness level and comfort. Many communities offer senior-specific outdoor clubs and guided excursions.

Popular Retirement Cities and Towns

Selecting the right community involves aligning your priorities with a location’s offerings. Colorado provides diverse options for retirement, each with its own character and advantages. You should explore several areas before making a decision.

Denver and Surrounding Suburbs

* Pros: Excellent healthcare, cultural attractions, major airport access, diverse dining and entertainment.

* Cons: High cost of living, significant traffic congestion, competitive housing market.

* Lifestyle: Urban, fast-paced, ideal for those seeking comprehensive amenities and city life.

Colorado Springs

* Pros: Lower cost of living than Denver, stunning Pikes Peak views, military retiree friendly, strong community feel.

* Cons: Can feel sprawled, some areas lack walkability.

* Lifestyle: Suburban, active, with a focus on outdoor access and community involvement.

Fort Collins

* Pros: Vibrant college town atmosphere, extensive bike trails, craft breweries, strong healthcare options, often ranked highly for quality of life.

* Cons: Housing costs rising, can be seasonal with university student presence.

* Lifestyle: Energetic, outdoor-oriented, good balance of amenities and community.

Boulder

* Pros: Exceptional natural beauty, highly educated populace, strong health and wellness focus, extensive open space.

* Cons: Extremely high cost of living, particularly housing, very competitive market.

* Lifestyle: Outdoorsy, health-conscious, progressive, for those with a substantial retirement budget.

Grand Junction

* Pros: More affordable housing, milder climate (high desert), close-knit community, excellent access to Colorado National Monument and wineries.

* Cons: Fewer specialized healthcare options than Front Range, smaller cultural scene.

* Lifestyle: Relaxed, community-focused, ideal for those seeking affordability and less intensity.

Durango

* Pros: Scenic mountain town, outdoor recreation (skiing, rafting), historic charm, vibrant downtown.

* Cons: Higher cost of living for a small town, isolated location, heavy snowfall.

* Lifestyle: Adventurous, small-town feel, suited for active individuals who love mountain living.

Choosing Your Community

Consider factors such as proximity to family, preferred climate, access to specific medical specialists, and desired community size. Visiting potential locations during different seasons provides a realistic impression of daily life.

Relocation Planning: Your Step-by-Step Guide

Relocating for retirement is a significant undertaking that benefits from careful planning. A structured approach helps ensure a smooth transition to your new Colorado home. Follow these steps to prepare effectively for your move.

- Assess Your Needs and Priorities: Define your non-negotiables for retirement, including budget, climate preferences, healthcare access, and social opportunities. This helps narrow down potential Colorado locations.

- Extensive Research: Dive deep into specific towns and cities. Investigate cost of living, tax structures, available amenities, and local community demographics. Use resources like the U.S. Census Bureau and AARP Livable Communities for data.

- Visit Potential Locations: Plan extended visits to your top choices, ideally during different seasons. Spend time in neighborhoods, visit grocery stores, talk to locals, and experience the daily rhythm.

- Develop a Realistic Budget: Factor in not just housing, but also utilities, transportation, food, entertainment, and healthcare. Include potential relocation costs.

- Plan for Healthcare: Research local doctors, hospitals, and pharmacies. Transfer medical records and ensure continuity of care. Understand how your insurance will work in a new state.

- Downsize and Declutter: Begin sorting through possessions well in advance. Decide what you truly need and what you can sell, donate, or discard. This streamlines the moving process.

- Arrange Your Move: Obtain quotes from reputable moving companies. If you plan a DIY move, reserve rental trucks and equipment. Consider temporary housing if your new home is not immediately ready.

- Update Important Documents: Change your address with the post office, Social Security Administration (USA.gov for general info), banks, and insurance providers. Obtain a new Colorado driver’s license.

- Get Involved Locally: Once settled, seek out local clubs, volunteer opportunities, and community events. Integrating into your new community enhances your retirement experience. The Eldercare Locator can help find local services.

Frequently Asked Questions

What are the best outdoor activities for seniors in Colorado?

Colorado offers a wealth of outdoor activities suitable for seniors. Popular options include gentle hiking trails in state parks, scenic biking paths, fishing in numerous lakes and rivers, and accessible golf courses. Many communities provide senior-specific outdoor programs. You can find opportunities for kayaking, bird watching, and even snowshoeing on groomed trails, allowing you to stay active amidst stunning natural beauty.

How expensive is healthcare for retirees in Colorado?

Healthcare costs for retirees in Colorado are generally comparable to the national average, though specific expenses vary based on individual needs and insurance plans. Colorado boasts a strong healthcare infrastructure, particularly in its major metropolitan areas like Denver and Colorado Springs. The state features a high concentration of hospitals and specialists. Many retirees rely on Medicare, which helps manage expenses, and you should research supplemental plans to cover gaps. Accessing and comparing plans through Medicare.gov provides the most accurate cost estimates for your situation.

Is Colorado a tax-friendly state for retirees?

Colorado offers some tax advantages for retirees, though its overall tax burden is moderate. The state provides a significant deduction on retirement income for individuals aged 65 and older. This deduction applies to eligible public and private pension income. Colorado has a relatively low flat income tax rate. Property taxes vary significantly by county, while sales tax rates are moderate. Understanding these factors helps you assess your specific tax situation. Refer to the Tax Foundation for detailed state tax comparisons.

What is the cost of living like in Colorado for retirees?

The cost of living in Colorado generally exceeds the national average, primarily driven by housing expenses in popular Front Range cities. Groceries and utilities can also be slightly higher. However, costs vary widely across the state. Rural and smaller Western Slope towns often present more affordable options compared to metropolitan areas like Denver or Boulder. You should carefully research specific communities to understand their local cost of living index. Consider factors like housing, transportation, healthcare, and everyday necessities when budgeting for your Colorado retirement.

Are 55+ communities popular in Colorado?

Yes, Colorado features a growing number of 55+ communities, particularly along the Front Range and in popular retirement destinations. These communities offer active adult lifestyles, often with amenities such as clubhouses, fitness centers, golf courses, and social events. They cater to seniors seeking a maintenance-free living environment and opportunities for social engagement. Research specific communities to find one that aligns with your lifestyle preferences and budget.

How does Colorado’s climate affect retirement planning?

Colorado’s climate is characterized by abundant sunshine, dry air, and four distinct seasons, but it also features significant variations by region. Front Range cities experience milder winters with less snow than mountain towns, which see heavy snowfall ideal for winter sports. Summers are generally warm and dry. High altitudes might affect some individuals, especially those with respiratory or cardiovascular conditions. You should consider your preferences for snow, sun, and altitude when choosing a specific location in Colorado. The National Weather Service provides detailed local climate data.

Colorado offers a compelling retirement destination for active seniors who value natural beauty, outdoor recreation, and vibrant communities. While the cost of living, particularly housing, can be higher than the national average, the state’s tax benefits for retirees, abundant sunshine, and strong healthcare infrastructure present significant advantages. Your ideal Colorado retirement location depends on your personal priorities regarding lifestyle, budget, and climate preferences. Thorough research and a visit to potential communities allow you to make an informed decision about where to build your new life.

Disclaimer: This article is for informational purposes only. Cost of living, taxes, and local conditions change over time. We encourage readers to verify current information through official sources and visit potential retirement destinations before making relocation decisions.

Leave a Reply